TL:DR

Most businesses want to accept card payments directly in WhatsApp, without forcing customers to external portals. Most adults have debit or credit cards, but most small businesses don’t have fancy card terminals and nobody likes clunky payment portals. Now you can integrate Stripe into WhatsApp and let customers pay, upgrade, get an invoice, and chat, all in one place.

Why payments needed a rethink

Anyone who’s ever run a business knows: getting paid should be simple, but it usually isn’t. You send a payment link, the customer gets bounced to an external portal, and suddenly… silence. Payments die in a sea of forgotten tabs and abandoned carts. Or, your customer doesn't have cash to pay.

But here’s the thing: Over 60% of the world’s adults have a debit or credit card. In North America and Europe, card access is almost universal. Even in Latin America, where WhatsApp is king, most buyers have cards. The bottleneck isn’t the cardholder, it’s the user experience.

Business, meet Stripe, right in WhatsApp with AI Assistants, Chatbots and Agents

If you’re still sending your users to a clunky page, you’re asking for lost sales. Customers expect everything in one conversation: quotes, questions, promotions… and, yes, payments.

With Invent, you link your Stripe account to WhatsApp in minutes (seriously, here’s how), drop in a payment action, and you’re off to the races.

No more portals: Your customer chats, pays, and gets confirmation in the same WhatsApp thread. Friction-free.

No extra apps or tabs: All card info goes straight into Stripe’s ultra-secure flow, never through your hands, never exposed to chat.

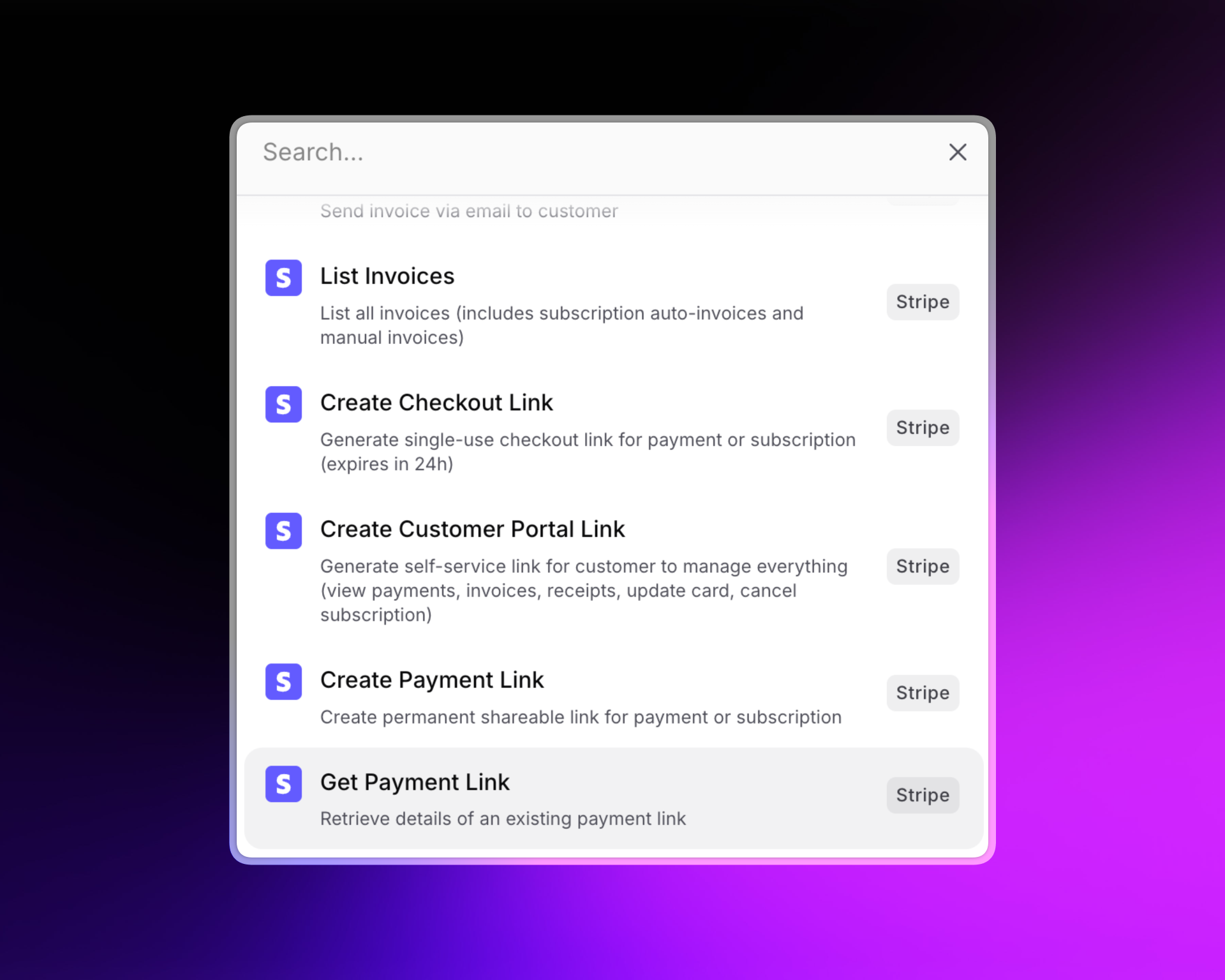

Stripe integration options: Quickly list invoices, create one-time or permanent checkout/payment links, provide customer self-service portals, and retrieve payment link details, streamlining payments in messaging channels.

Source: Invent interface Stripe actions

Why receiving payments through WhatsApp matters for SMBs, and their customers

Big reach, zero friction:

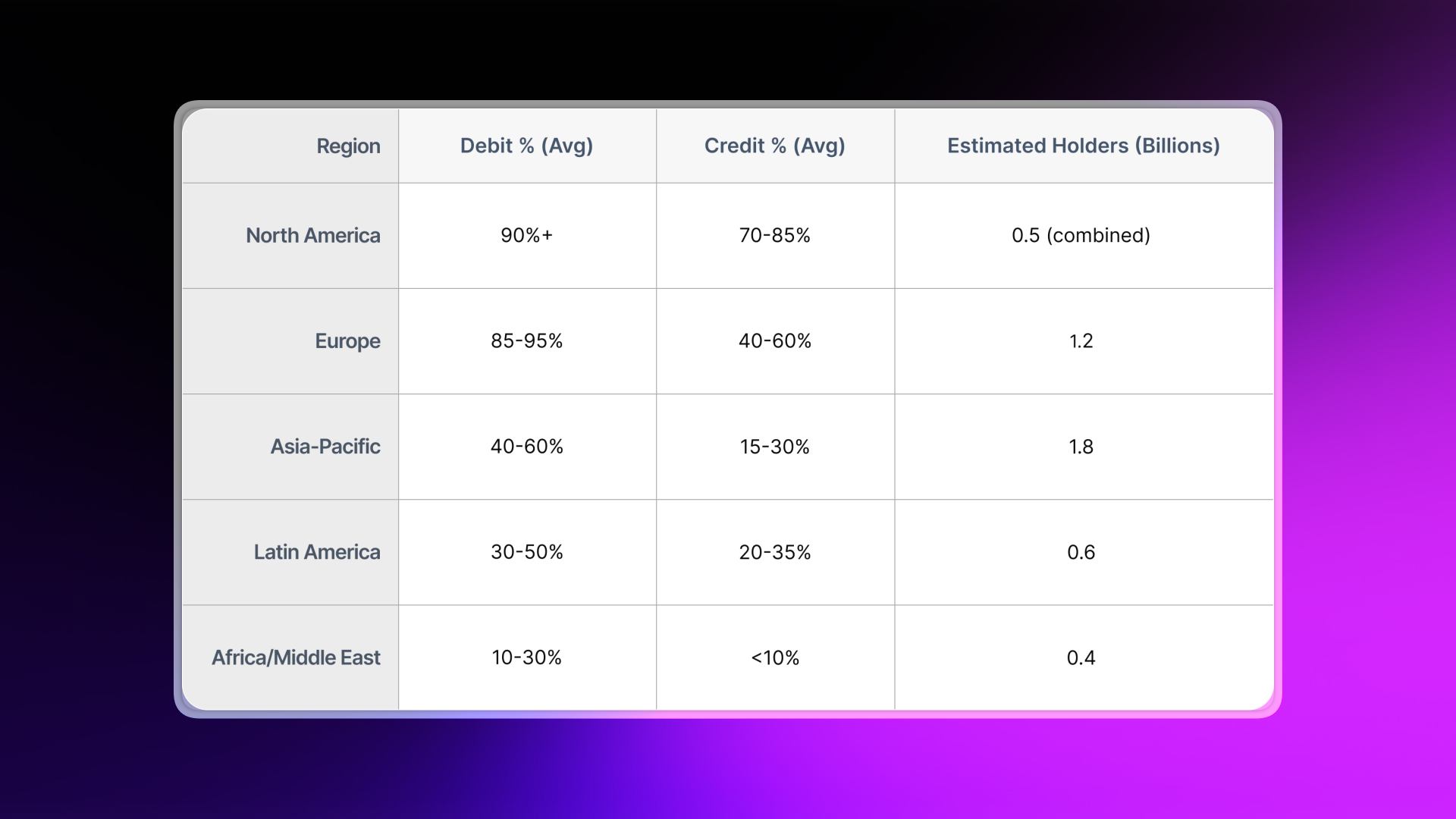

Over 4.5 billion adults worldwide, more than 60% of those aged 15+ carry credit or debit cards primed for digital payments, as shown in the regional breakdown table.

The table reveals stark contrasts: North America and Europe lead with 90%+ debit penetration and 40-85% credit ownership, delivering 1.7 billion holders from high-income density, while Asia-Pacific's massive 4+ billion adult population scales moderate 40-60% debit rates into 1.8 billion users.

Emerging regions like Latin America (0.6B) and Africa/Middle East (0.4B) round out the total at lower rates but accelerating growth, creating a $10T+ addressable market for conversational AI checkouts on WhatsApp, web chat, and SMS via Stripe integrations.

Global cardholder adoption by region: North America and Europe lead with 90%+ debit card usage and high credit card ownership, totaling 1.7B cardholders. Asia-Pacific’s population drives 1.8B users with moderate penetration, while Latin America and Africa/Middle East contribute another 1B+ at lower but rapidly growing rates, powering a $10T+ conversational AI payments market.

Source: The Global Economy, 2026

Ready to welcome the world?

If you’re a tourist destination, now’s the time to meet your guests where they are, on messaging apps they already use. With billions of travelers carrying debit and credit cards primed for digital payments, offering seamless conversational checkouts in WhatsApp or web chat, makes it effortless for tourists to book, buy, and pay in seconds, even before they arrive. Multilingual is a great feature you can add to your business.

"Conversational commerce will be a turning point for driving digital payments and the growth of the digital economy. WhatsApp must offer the full circle: payment initiation, authorization and confirmation of payment receipt. All without leaving the app."

Jorge A. Ortiz

Founder and Ideator

THE COMMON SENSE PROJECT

WhatsApp users in Brazil can now pay merchants through WhatsApp

One standout success is Brazil’s integration of generative AI and the Pix instant payment system directly within WhatsApp. Major banks such as PicPay, Itaú Unibanco, and Nubank are making it possible for users to transfer money through simple chat messages, including text, voice, or images, eliminating the need to switch between apps. AI handles verification and sends receipts, delivering a truly frictionless experience.

The impact is remarkable

Pix facilitated 56 billion transactions in 2024, and mobile banking adoption has soared to 90%, well ahead of the US. This model, combining trusted technology and regulatory support, has positioned Brazil as a leader in digital payments, and is now under scrutiny by peers and regulators worldwide.

Example of seamless payments in WhatsApp: A user sends R$100 as a gift via chat, demonstrating in-thread digital payments in Brazil.

Source: © FT montage; WhatsApp

Accept Stripe payments in WhatsApp

While Brazil’s banks have pioneered fully embedded, in-chat payments, businesses elsewhere can offer customers a smooth, secure payment journey using solutions like Stripe. Here’s how:

- Integrate with your messaging channel

Engage customers where they already are, your website chat, SMS, WhatsApp Business, or social media DMs. When a customer is ready to purchase, your agent or bot can generate a payment link. - Share secure payment links (Stripe, etc.)

Send a one-time, secure Stripe payment link (or QR code) directly in the chat. Customers simply tap the link to open a trusted, mobile-friendly conversational checkout page, pre-filled with the amount and item details. - Customer authenticates & pays

Stripe handles sensitive payment data and security. The customer completes checkout using their card, Apple Pay, Google Pay, or local payment methods. Depending on local requirements, they may verify via PIN, SMS, or biometrics. - Instant Payment Confirmation

Once payment is complete, Stripe instantly notifies your backend. You can automatically update the chat (or your customer’s inbox) with a real-time receipt or confirmation message.

Why it’s safer using Stripe on WhatsApp for you and your customers

- No sensitive data in chats: Payment info is never typed into the chat; everything happens within Stripe’s secure, PCI-compliant environment.

- Strong authentication: Every transaction uses bank-level security, keeping your business and your customer protected.

- Automated fraud prevention: Stripe and similar platforms have advanced tools to spot and block suspicious activity.

- Audit trail: You can track, reconcile, and automate reporting easily.

FAQs

1. How do I set up digital payments on WhatsApp with Stripe?

Just connect Stripe under Invent Actions, select WhatsApp as your channel, and add the payment collection action. Done, your AI assistant collects payments in-chat.

2. How do I link my bank account for WhatsApp payments?

Set up your bank in Stripe (guide), then let Invent handle the rest, no additional integrations needed. You just need to add the action related to your needs.

3. Can I request money from contacts via WhatsApp?

Yes. Trigger payment requests, set due dates, and send reminders, your assistant keeps the thread going until the payment lands in your bank.

4. How do customers pay, step-by-step on WhatsApp?

Open WhatsApp with your business/assistant.

Express intent (“I want to pay” or “My bill, please”).

The AI confirms the amount and sends a secure Stripe link no switching apps.

Customer pays with their card, right there.

Receipt and confirmation show up in the chat.

5. Is accepting credit card payments in WhatsApp secure?

Safer than most in-person transactions. Card details flow straight from the customer to Stripe or PayPal, fully encrypted, globally trusted. No PCI headaches for you, no risk for them.

Who else offers this?

You might see payment bots from Intercom, Drift, or Twilio Flex, but Invent is built for omnichannel, with zero code and zero friction for business owners and users.

6. Our guests already pay with cards, what’s the benefit of adding payments to chat, and why does AI language support matter?

Let guests book and pay instantly, right inside WhatsApp, SMS, or your website chat in their own language. You’ll remove barriers, boost bookings, and give every traveler a smoother, more welcoming experience.

The bottom line

If your business is still stuck chasing payments through portals, you’re living in the past. With Invent and Stripe, your customers get world-class UX, and you get paid, in chat, every time. Get started today. Your future self will thank you.

With a Stripe-integrated WhatsApp chatbot, your business can accept credit card payments, ACH, or instant transfers, all in one place.

Ready to automate payments in WhatsApp with Stripe?

Try Invent now or schedule a demo.

Learn by Example

Want to see a complete, real-world assistant built step-by-step?

Explore Invent’s Learn by Example guide for a full yoga studio booking assistant using Google Sheets, Calendar, Stripe, and WhatsApp.