TL;DR

- AI-driven financial assistants allow millions to budget, invest, and save smarter, but not all regions offer seamless account syncing.

- 59% of Americans have used chatbots; global usage is expanding.

- Flexible AI tools that support manual tracking and custom input empower users everywhere, not just in countries with “all-in-one” apps.

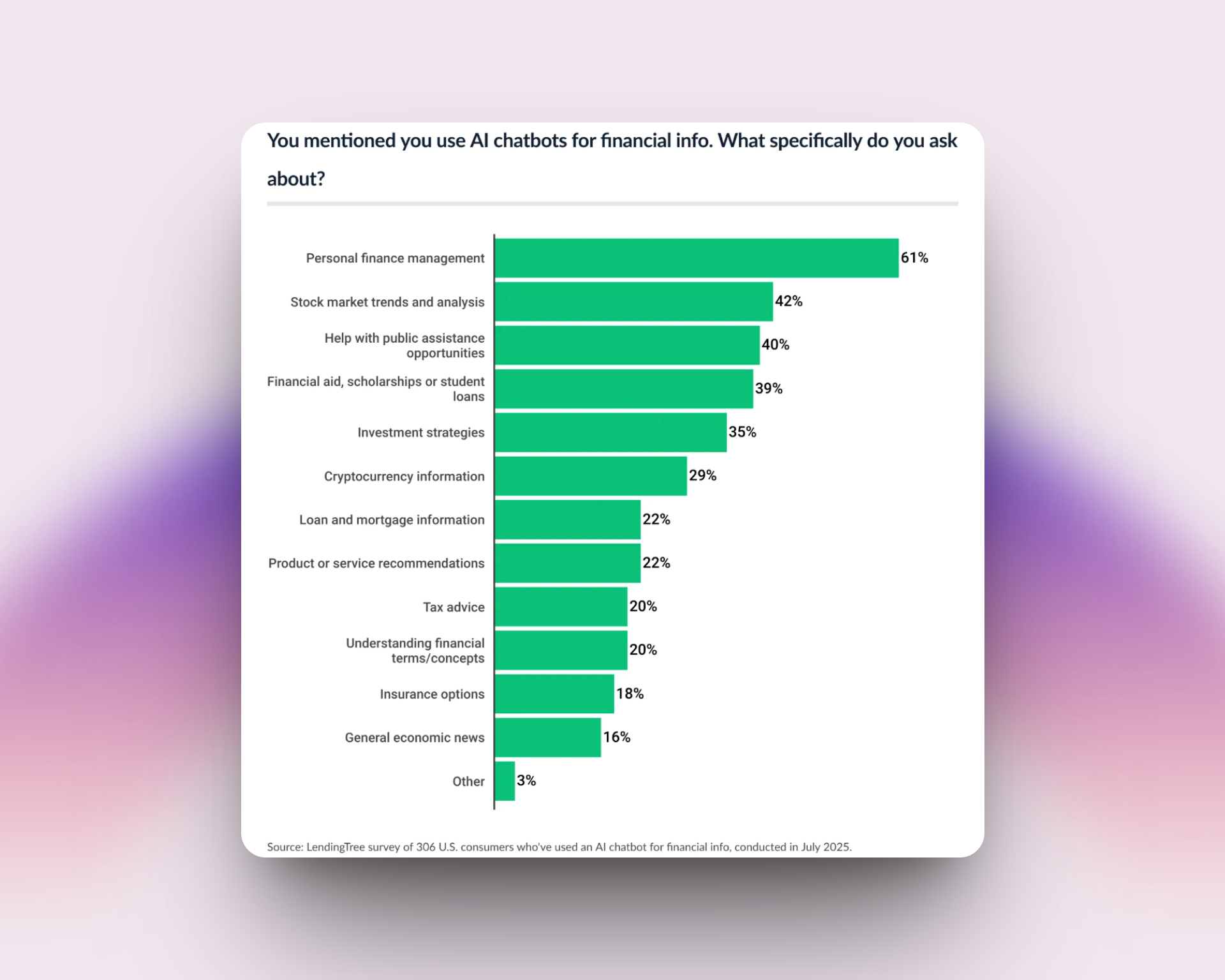

- Only 26% of AI users ask chatbots for financial info, mostly about managing personal finances, tracking stocks, or finding help with public assistance.

LendingTree 2025 Survey Results: U.S. consumers most often use AI chatbots for personal finance management (61%), stock analysis (42%), and public assistance (40%). Other popular uses include financial aid, investments, crypto info, and loan advice, demonstrating the broad appeal and versatility of AI financial assistants. https://www.lendingtree.com/credit-cards/study/ai-chatbot-users/?utm_source=chatgpt.com

Why it’s hard to track all your bank, credit card, and investment accounts internationally

In the U.S., apps like Mint, RocketMoney or Personal Capital (now Empower) can link to nearly every financial account. But in much of the world, this level of integration just does not exist due to:

- Lack of open banking/APIs

- Financial institutions not supporting third-party linking

- Regional rules and tech barriers

- Limited coverage for local banks, e-wallets, or international brokers

What this means for users

Many must manually track credit cards, investments, or loans using pen and paper, spreadsheets, or upload tools, even sending random notes through WhatsApp.

The challenge is that most traditional apps don’t allow global account aggregation, mixed currencies, or customizable organization.

How AI personal finance assistants and chatbots can help with manual account tracking, global account aggregation, and custom integrations

1. Manual and flexible data entry

- Custom Imports: Easily add credit cards, savings, or investment balances via Notion, Airtable, copy-paste, or spreadsheet upload (CSV/Excel).

- AI Categorization: Your bot remembers how you label and organize accounts, making manual input fast and seamless.

2. Intelligent reminders & insights

“Don’t forget to check your Bank X statement this week”

"We added $50 usd to the Dinner category"

“Update your investment portfolio from your broker’s website every month for best results.”

"Remember that you are building your empire, do not waste more on your weekend"

3. Hybrid Integrations

- For countries with supported APIs, connect directly for live balances.

- For everyone else: native integrations make it easy to connect with your current CRMs and data.

4. Data control & global privacy

- On the Assistant Memory, Knowledge base or cloud storage, you decide.

- All entries and data remain private, with strong encryption and user consent at every step.

5. Plug in your favorite tools and channels

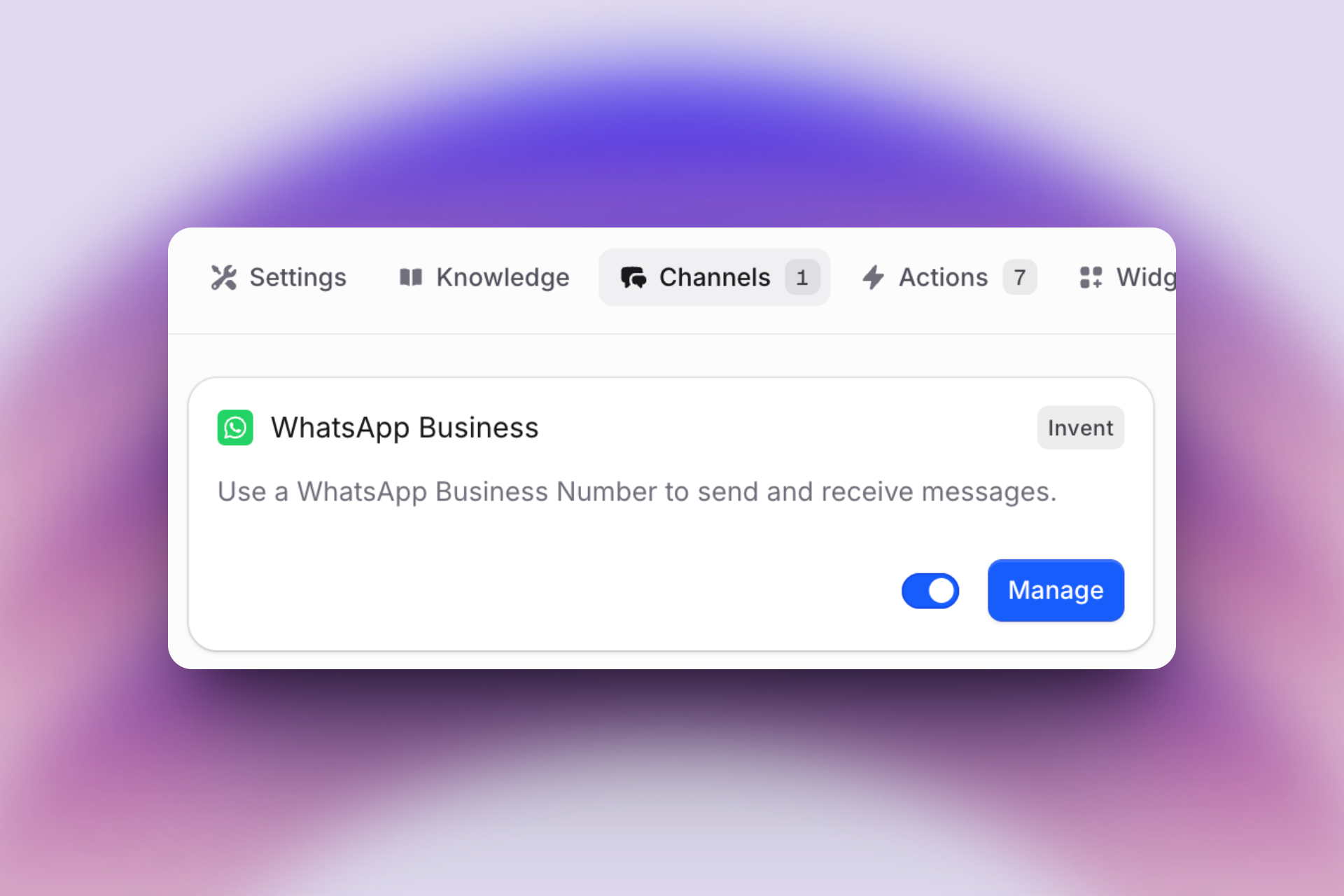

Customizing your AI finance buddy with the apps, tech stack, and channels as WhatsApp, Telegram and others you already use makes it even more powerful. This way, your assistant fits right into your workflow, helping you track accounts manually or globally, connect with custom integrations, and get reminders wherever you prefer to chat.

WhatsApp Business channel connected: Easily manage your WhatsApp Business integration to send and receive messages directly from the platform. The “Manage” button offers streamlined control, making setup and ongoing management effortless.

6. AI Personal finance buddy

Don’t go it alone or talk to a brick wall, let your AI money buddy offer real encouragement, friendly reminders, and personalized guidance. It learns your unique needs and even your “puntos débiles,” helping you save smarter and feel truly supported along your financial journey.

Why this matters

Democratizing money management:

You shouldn’t be left out of the AI finance revolution just because your region isn’t covered by a big aggregator.

Customized to Local Reality:

The assistant adapts to your local banks, currencies, and investment products.

Empowerment for All:

Users in any country can finally see their full financial picture, with or without automatic syncing.

Building the ultimate AI personal finance Assistant: Features, models & integrations

Broad model access means better results

Multiple AI Models: ChatGPT, Claude, Gemini, Grok etc., cross-check each other’s advice for reliability and a richer perspective, then select the best that fits your needs.

Up-to-date Knowledge:

Different LLMs may be trained on diverse data, giving stronger answers, especially as regulations and products change.

Deep Integration with Knowledge Bases and Tools

Connect to trusted resources: IRS, SEC, CFPB, local financial authority databases

Personal Knowledge base expansion:

Save your own data (bank PDFs, transaction logs) for the AI to reference and organize

User-centric tracking

Universal account entry: Whether your bank syncs or not, the assistant helps aggregate, suggest categories, and reconcile across all accounts.

FAQ

What if my bank doesn’t connect automatically?

You can manually add balances, upload CSVs, or use simple forms. The AI will remind you to check for updates and spot trends or inconsistencies.

Does this AI only work for US or UK accounts?

Not at all, our vision is for every market. You control your accounts, currencies, and institutions. Manual or hybrid entry is supported globally.

Can the AI offer useful insights without automatic connections?

The more you enter, the more the assistant can help, spotting trends, flagging unusual charges, and delivering savings nudges.

How do I keep my financial data safe?

All information is encrypted and controlled by you. You choose what to sync or store, local-only options are always available.

What are the benefits of building my own AI finance assistant instead of using a generic app?

Your AI money buddy adapts to the voice and style you’re most comfortable with, whether you want friendly encouragement, gentle reminders, or straight-to-the-point advice. That’s important, because when financial guidance feels personal and approachable, you’re more likely to stay motivated, stick to your goals, and actually enjoy building better money habits.

Building your own is a win-win: When you create your own AI finance buddy, you not only get a solution tailored to your unique needs, but you also learn valuable tech and money skills along the way. And if your assistant works well, you’ll have a template you can share, or even sell, to friends, family, or anyone who wants a smarter way to manage their finances.

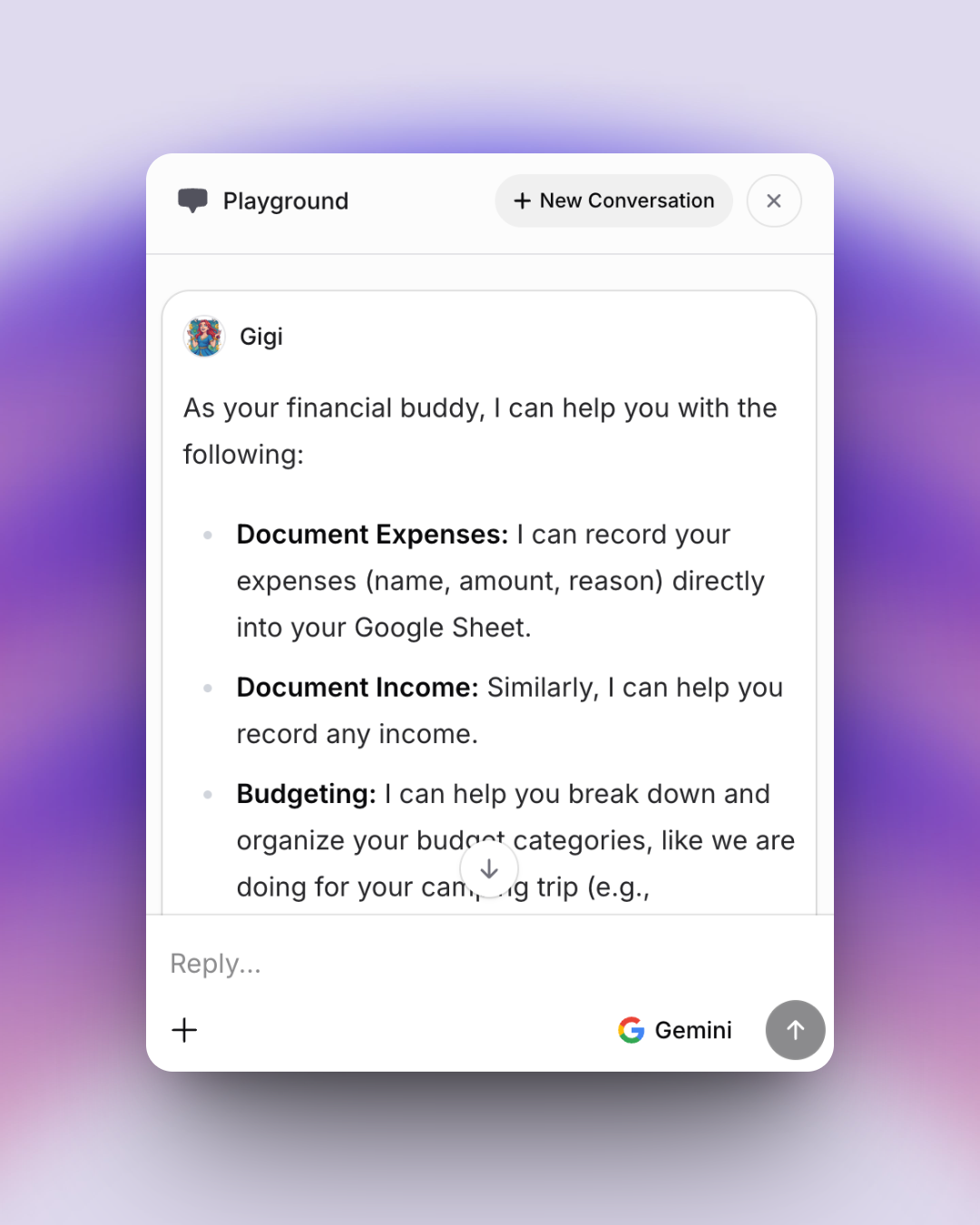

Playground chat: The assistant offers to document expenses, record income, and help with budgeting, personalizing guidance and using Google Sheets for organized tracking. Perfect for hands-on financial coaching and managing special projects like trip planning.

Tip: AI is your smart assistant, but you’re still the driver. LLMs can sometimes sound confident, even when they’re off track or make up sources. Trust your judgment: always check links and make the final call yourself.

Conclusion

An AI personal finance assistant in 2026 is about accessibility, flexibility, and inclusivity.

We encourage you to embrace AI and shape it to your unique needs. Whether you want to build your own finance assistant and fully own your data, work with a trusted developer to create a bespoke solution, use a reputable AI service where you control your privacy, or simply pay for a secure and convenient monthly subscription, there’s a path that fits every lifestyle, comfort level, and set of values. Put yourself in control, and let AI empower your financial journey, your way.

No matter where you live or which banks you use, the right AI can help you track, understand, and improve your finances, one smart, secure nudge at a time.

Ready to start your own financial assistant or chatbot?

It’s pretty simple, Invent is made for real people, not just techies. Give it a try and see how easy (and kind of fun) building your own money buddy can be.