Voice Agents vs IVR vs Chatbots: When each wins

People don’t always want to tap through menus or read long pages. Sometimes they just want to say it out loud and get it done, on a call, in a voice note, or inside your app.

Here’s is what each channel is good at, where it struggles, and how to pick the right one for your customers.

Definition of Voice Agents vs IVR vs Chatbots

1. IVR (Static or Basic Speech IVR)

“Press 1…” trees or fixed recordings.

Predictable, cost-effective, but rigid. Great for hours, routing, or required messages.

2. Basic Chatbots (Text, aka "FAQ Bots")

Rule-based bots on websites, apps, or messaging.

Best for simple questions, quick links, or menu navigation. Quiet and efficient, but limited to scripted answers.

3. Natural Language Text Agents (Smart Chatbots)

Advanced conversational bots that understand and process natural language.

Handle tasks like scheduling, payments, or account changes. More flexible and capable than basic bots.

4. Voice Agents (Conversational AI for Voice)

AI that understands real speech, not just calls, but also in-app microphone, VoIP, or voice notes (WhatsApp, Telegram, etc.).

Great for time-sensitive, complex, or multi-step tasks best spoken aloud. Listens, confirms, and follows up.

Quick decision guide

Use IVR when:

You only need hours, closures, routing, or legal messages.

Predictable, cheap, but rigid.

Use a chatbot when:

Users are already on your website or app.

They need links, files, or prefer silent/text interaction.

Great for answering FAQs, sharing links, simple menus.

Use a voice agent when:

The task is time-sensitive, multi-step, or easier to say than type.

Applies across calls, in-app mics, and voice notes.

Ideal for scenarios like identity check → account change → real-time confirmation.

High-Impact Fintech voice agent scenarios

1. Proactive spending insights & personalized offers

User:

“How much did I spend on restaurants this week?”

Voice Agent:

“You spent $48 on dining this week, which is $12 less than last week. If you keep this pace, you’ll save $50 by month-end.

Would you like personalized cash back offers for restaurants near you, or set a dining budget alert for next month?”

Why it’s attractive:

- Drives engagement with spending insights

- Promotes behavioral nudges & cross-sells (offers)

- Increases usage of digital channels

2. Automated recurring savings with smart recommendations

User:

“Remind me to save $50 each week.”

Voice Agent:

“Done! Weekly $50 savings reminders are set for every Friday.

Based on your income and expenses, would you like to try our SmartSave tool to automatically adjust the amount when your balance allows? This could help you reach your savings goal even faster.”

Why it’s attractive:

- Increases customer stickiness (more app interactions)

- Cross-sells advanced products (like SmartSave)

- Promotes financial wellness tools

3. Context-aware account management

User:

“My new email is gigi@useinvent.com.”

Voice Agent:

“Thanks, your email has been updated. By the way, your last statement wasn’t delivered. Would you like to review your mailing address as well?

Also, shall I send you a digital statement to your new email?”

Why it’s attractive:

- Reduces contact center workload (less manual updates)

- Improves data accuracy for compliance

- Boosts adoption of digital statements (cost savings)

Why these scenarios win:

- Direct business value: Lower costs, more engagement, upsell/cross-sell, and digital adoption.

- Practical, scalable automation: These are frequently requested actions with clear impact.

- Modern, seamless experience: Shows users you’re leveraging AI for customer delight and efficiency.

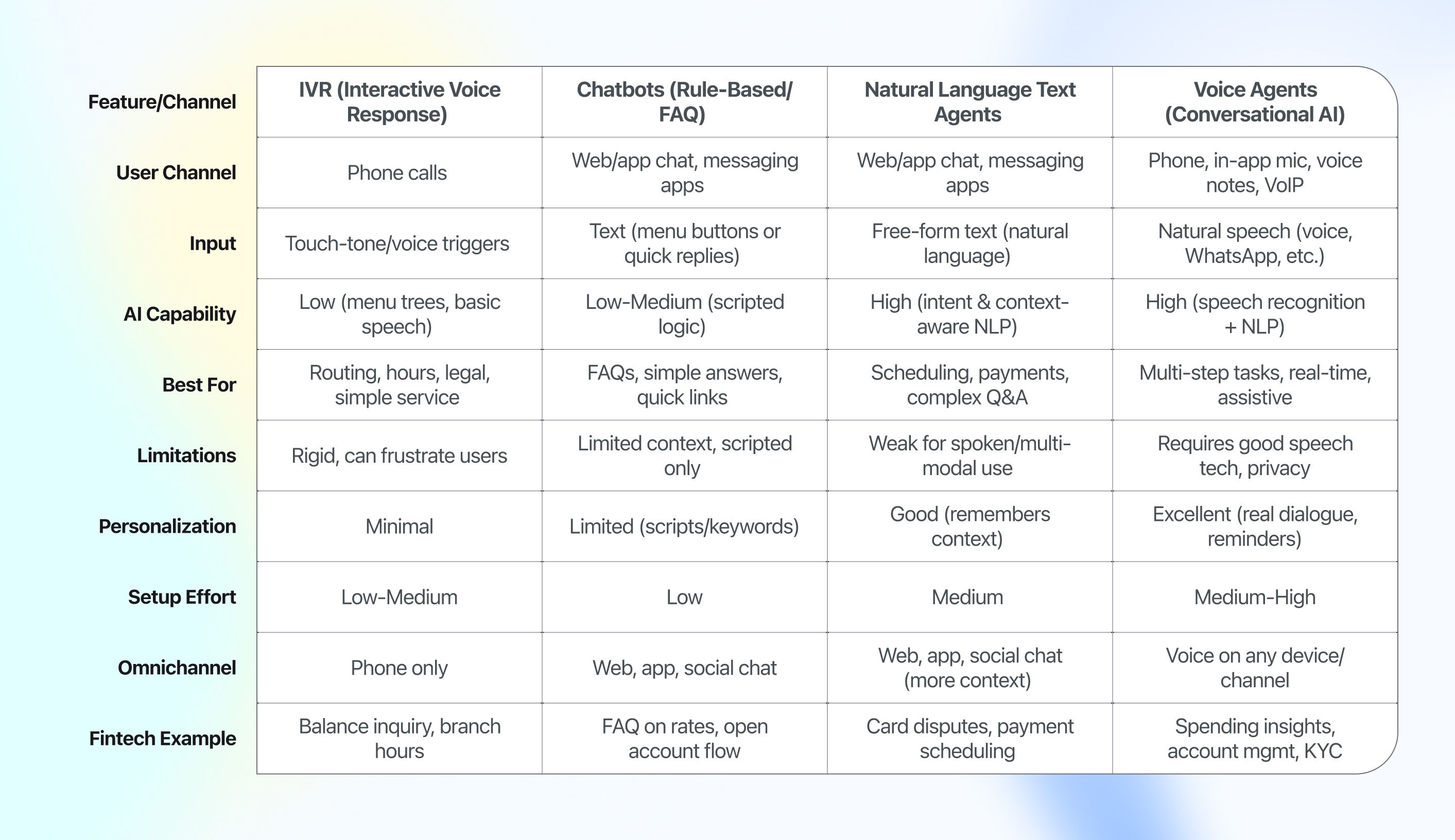

Voice Agents vs IVR vs Chatbots: Quick comparison table

Ready to start?

Which channel is right depends on your customer needs and context.

Want to build your own assistants and agents, or ready for a demo with our team? Let’s talk!